Performance update

-

DTP - Enhanced Risk (USD) Composite

Inception date:

01 Jan 1995 -

25 Jul 2024

-1.64%

MONTH TO DATE

-5.54%

-

MONTH TO DATE

-5.54%

-

YEAR TO DATE

6.96%

INCEPTION TO DATE

10.82% p/a

-

INCEPTION TO DATE

10.82% p/a

This data should be viewed in conjunction with the explanatory notes, which are an integral part of this performance data. THE VALUE OF YOUR INVESTMENT CAN FLUCTUATE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Diversified Trend Program

-

Active and adaptive trend-based trading strategy, attuned to the major developments in the world

-

30+ years track record providing attractive risk-adjusted returns with low correlation to the major asset classes

-

Coherent, sustainable and proven investment process

Approach

Our Diversified Trend Program (DTP) is a managed futures program, trading live since June 1992. The program has an absolute return objective and does not follow, nor specifically strives to outperform, any benchmark or index. Although DTP’s trading tools are fueled only by prices set in the individual markets traded, the program is geared towards capturing the broader underlying trends. The goal is to be sizably positioned in different trends, with a balanced risk allocation across the factors driving current trends.

Most price trends in markets are a reflection of broader trends and developments in our continuously evolving society. Each single development — such as a move towards the exploration of shale oil, or a move towards driving electric cars — is typically reflected by price trends in a number of different markets. In our approach, we identify such a development as just one trend. With DTP we strive to be positioned in different trends. This requires trading many different markets, including alternative markets and ‘synthetic’ market combinations. These markets are selected and constructed as our vehicles to ride the underlying trends.

Our focus on the factors that really drive markets has the most far-reaching consequences for DTP's portfolio construction process. Even though in our investor reporting we do present risk allocation charts across different asset classes (commodities, interest rates, currencies, etc.), these asset classes have never played any role whatsoever in our actual position sizing — the real factors that drive markets typically exceed such asset class boundaries.

The world continuously changes. And our markets continuously change. It’s these developments that drive us and drive our trading program.

A strong feature of DTP is its demonstrated ability to perform well during crisis periods, especially those accompanied with extended stock market declines. Our investors appreciate this — it makes DTP a welcome addition to their investment portfolios. But this feature does not come automatically with the program’s investment style. It is the aimed for result of many choices we deliberately make — choices that are at the very heart of our investment process.

Also at the heart of our approach is the acknowledgement that we have to continue developing and adjusting all components of DTP to stay in sync with the markets. New markets spring up, others wither. And the ongoing modernization of market platforms and the shifts in behavior of their participants is continuously and fundamentally changing market dynamics. Such developments cannot be neglected; we believe that no trading strategy can be used for more than a few years without adaptations. An evolving world requires an evolving approach: the 30+ years track record of DTP is the result of that.

Broad access to trends

The investment universe of DTP consists of more than 500 futures, forwards and swap markets across multiple asset classes, providing access to trends via a combination of mainstream and alternative markets, including many 'synthetic' market combinations.

Inflation protection

Among the recent themes that helped shape DTP’s horizon of traded markets is inflation. The leading idea is that the program should be able to profit well from rising commodities in such an environment, providing investors with protection against inflation.

Read our article Investing in commodities as an inflation hedge? to learn more.

Proven 'crisis alpha'

DTP has a demonstrated ability to perform well in times of crisis, such as the Dot-com Collapse (2001-2002), the Credit Crisis (2007-2008) and the Covid-19 pandemic.

Select a period in the graph below to learn more.

The DTP returns represent composite performance figures of the Enhanced Risk (USD) subset of DTP. This data should be viewed in conjunction with the explanatory notes, which are an integral part of this performance data, and the description of indices used. Equities are represented by the MSCI DM World Index (Net/Local Currency), Bonds are represented by the Bloomberg Barclays Capital U.S. Aggregate Bond Index, Commodities are represented by the S&P GSCI Total Return (USD), Managed Futures are represented by the Barclay BTOP50 Index, Hedge Funds are represented by the Credit Suisse Hedge Fund Index and Trend Following is represented by the SG Trend Index. Source of all data used in the chart and table: Refinitiv, Bloomberg, BarclayHedge and Transtrend. THE VALUE OF YOUR INVESTMENT CAN FLUCTUATE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

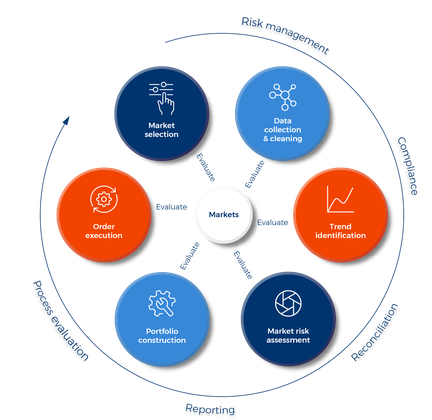

Trading process

Core principles

All elements of DTP are tightly interconnected and together form one coherent operation. Our trading process is based on the following principles:

In control

All key components are designed, maintained and operated in-house.

Adaptive

Continuous evaluation & improvement keeps DTP in sync with the markets.

Responsible

Contributing to well-functioning, well-organized and reliable markets.

Recent awards

More information on the awards is available here.

THE VALUE OF YOUR INVESTMENT CAN FLUCTUATE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

How to invest

Our Diversified Trend Program is available via a range of different investment vehicles and formats that are tailored to meet specific client needs.

Funds

A variety of commingled funds provide access to DTP, among others the Luxembourg domiciled alternative investment fund Transtrend Fund Alliance (TFA) — for which Transtrend acts as Alternative Investment Fund Manager — and a UCITS.

Managed accounts

A separate managed account enables clients to create a bespoke portfolio, customizing among others liquidity, funding, investor restrictions, reporting and risk profile.

Other solutions

DTP is also available through other solutions, such as platform solutions and structured products.

For more information on these investment options, please contact our Investor Relations team.

Get in touch with us

Heeregrave

Honig

van Loo