Real factor investing

Real factor investing is about acknowledging and respecting the real factors that drive markets. Why does Eugene buy a car?

Real factor investing is about acknowledging and respecting the real factors that drive markets. Why does Eugene buy a car?

Over the past decade, factor investing products have gained hugely in popularity. Many of these products aim to capture academically defined style factors such as value, low volatility and momentum. The popularity of these strategies is supported by numerous academic papers showing that these factors offer a statistical explanation of the returns of many successful investment categories. Suppliers of these strategies feed the assumption that for that reason simply aiming at these factors can easily replicate these returns at large scale for low costs, without market impact.

However, as we all know, a statistical explanation does not automatically equate to causality. And if there is no causality, one should question whether just chasing these factors would have resulted – and will sustainably result – in these returns in reality. We doubt this causality. We believe that people in the real world – and therefore ultimately the markets – are driven by other, more concrete factors. Respecting these real factors should be at the basis of an investment strategy. We would call that real factor investing.

Ultimately, markets are driven by supply and demand. And these flows of supply and demand are above all created by people running after ideas. Factor investing is such an idea; and as such it clearly creates flows of supply and demand. But does this represent real supply or real demand in the underlying markets? In a well-functioning market, prices will rise (timely) when future supply does not keep up with future demand otherwise. For stock markets this means that the value of a company will rise if the goods or services that it produces are in demand. And if not, it won’t. This principle holds for companies offering financial services, for companies selling advertisements on internet, and also for companies producing and selling cars.

This leads us to the question: Why does Eugene buy a car? Why does he pick this particular Volkswagen or that particular Tesla? Or why doesn’t Eugene buy a car? We can think of many different reasons.

Maybe Eugene recently got a new job in another town making him commute every day. Or maybe a fancy car is an important status symbol for Eugene; he will buy one as soon as he can afford it. This indicates an economic factor.

Maybe Eugene can get a cheap loan to buy a car. Or maybe the car Eugene buys is affordable because it is produced in a country with a cheap currency. This indicates a monetary factor.

But maybe the car Eugene wanted to buy appears too expensive due to import tariffs on the car or on components of the car. This indicates a geopolitical factor.

Or maybe the town that Eugene commutes to has a policy of discouraging car traffic to reduce pollution. Or maybe it is Eugene himself who strives to reduce his carbon footprint. This indicates an environmental factor.

Again, we can think of many reasons that could drive Eugene to buy or not buy a car. But the ‘defining factors’ value, size, carry, quality, low volatility and momentum in their academic meaning are not among them.

Respecting real factors driving markets should be at the basis of an investment program.

In our investments we focus on factors that really drive markets. With our Diversified Trend Program (DTP) we aim to be sizably invested in different trends. That means: trends driven by different factors. Such real factor investing starts by selecting the markets that are driven by these factors. That is not done by just selecting the large mainstream markets. But it can also not be done efficiently by simply adding as many markets as possible to our universe. If a particular market offers no more than a more expensive way to ride the same trends that can be exploited more efficiently by positions in other markets, it makes no sense to add it.

Our focus on real factor investing also inspired our work on synthetic markets. For instance, when diverging monetary policies is a driving factor, the resulting trend can be traded most efficiently through explicit spreads between interest rate futures of these two economies. Most of our synthetic markets are specifically constructed to reveal and ride specific driving factors, irrespective of whether these drivers are economic, monetary, geopolitical, environmental or something else.

Our focus on real factor investing has always had the most far-reaching consequences for the portfolio construction layer of DTP. Even though in our investor reporting we do present risk allocation charts over different asset classes – interest rates, equities, currencies, etc. – in our actual position sizing these asset classes never played any role whatsoever. Because we realize that the real factors driving markets typically exceed such asset class boundaries.

For example, OPEC production agreements can be a relevant factor. Whenever this factor becomes too large a risk in the portfolio, it doesn’t make sense to size down positions in commodity markets. When the energy risk becomes too large, we size down the positions that contribute to that risk. Those could be positions in commodity markets (for instance in oil or distillates), but also positions in currency markets (for instance in the Russian ruble or the Norwegian krone), and positions in stock markets (for instance in Total or Chevron). Sizing down positions in commodities like cattle will not help; it takes a million years for a cow to fossilize into a drop of oil.

Real factor investing must be accompanied by the use of non-linear correlation measures.

Correlations are at the heart of DTP’s portfolio construction layer. Focusing on the real factors driving the markets, acknowledging that correlations stem from a shared sensitivity to one or more common factors, we realized from the start that we couldn’t use linear correlation measures like Pearson’s. To illustrate this, think of two markets (I and II) that are driven by two factors (A and B).

Assume that in response to factor A, both markets will go up; in response to factor B, market I will go up and market II will go down. Now suppose that for some time factor A has been the dominant factor (with factor B slumbering), causing both markets to be in an uptrend. And suppose the strategy is long both these markets. How should the positions be sized? That depends on the answer to another question: What are the risks? In this particular situation with only two factors, two things could happen: i) Factor A could lose strength or even reverse, in which case the uptrend in both markets will break or ii) factor B could strengthen (gradually or suddenly), in which case the uptrend in market I will accelerate while the uptrend in market II will break.

From a risk management perspective, the only relevant factor in this situation is factor A. The common sensitivity of both markets to this factor allows for coinciding losses in the worst-case scenario. With a linear correlation measure – estimated using the historical returns of markets I and II – the calculated correlation will be an average of i) the positive correlations observed during the periods when factor A was dominant and ii) the negative correlations observed during the periods when factor B was dominant. The resulting average correlation would therefore underestimate the in this case relevant common dependency. In other words: while riding the trend driven by factor A, the risk associated with factor A is underestimated.

But even worse, think what happens if the strategy is short market I and long market II. Given the historic dominance of factor A, a linear correlation measure will estimate these positions as negatively correlated. However, if suddenly factor B takes over, the strategy will lose on both positions. In this case, the only relevant factor would be B.

This simple example isn’t purely hypothetical. Let market I be the 10-year German bund and market II the 10-year Italian bond. What constitutes factor A in this pair is clear: the ECB QE-policy. And let factor B be “doubts about the stability of the Eurozone”. This factor suddenly gained strength around the Brexit referendum in June 2016. And it flared up again in May 2018 when two populist movements came into power in Italy. Using linear correlation measures, which don’t respect these different real factors, could have resulted in missing out on opportunity and/or suffering unexpected outsize losses around these events.

The Brexit referendum and the Italian political shift are no isolated events. After many years during which markets were primarily driven by economic factors – these were the years during which trend following CTA-programs became popular – we’ve seen a sequence of years during which markets were primarily driven by monetary policies. These happen to be the years during which factor investing gained in popularity. However, since 2016 politics/populism has been making its mark in the market. Some even call it a paradigm shift. Both Brexit and the rise of the Italian populist movements represent this shift; other examples are the Trump presidency in the U.S. and the changing power dynamics in Turkey under Erdogan.

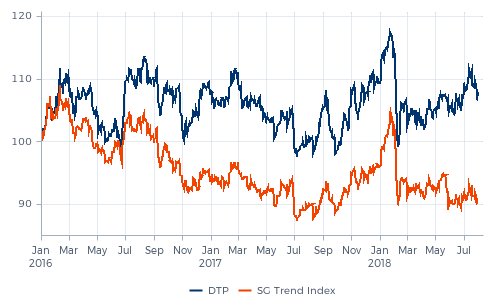

We don’t want to enter into a discussion whether we welcome this development or not. We simply observe that this shift has an impact on markets. Somehow, many factor investing products seem to have difficulty in dealing with this shift. Perhaps these strategies are overly optimized towards an environment dominated by monetary policies; factor A in our hypothetical example. The strategies offering momentum are having a particularly hard time since this shift. This is not limited to these strategies however – some other trend followers also seem to have difficulties in coping with this shift. This is reflected in the SG Trend Index, currently going through its deepest drawdown since inception.

DTP is also a constituent of this index. Although the performance hasn’t been spectacular in absolute terms, it has been positive since 2016. This would most probably not have been the case if we hadn’t focused on real factor investing, if we hadn’t strived for sizable positions in different trends driven by different factors, if we hadn’t used non-linear correlation measures that respect the real driving factors.

We realize that further improvements are necessary. We expect to find these improvements not by focusing on momentum, but by focusing even more on the real factors driving markets. One element of DTP will most definitely not be changed: all decisions, whether to be long positioned in a market, short positioned, or not positioned at all, will continue to be the outcome of strictly trend following trading rules. Whether this qualifies DTP as a momentum strategy or not is an academic discussion that we will gladly leave aside.

All performance data of DTP presented in this article are composite net performance figures of DTP - Enhanced Risk (USD) and should be viewed in conjunction with the explanatory notes, which are an integral part of this performance data.

All SG Trend Index performance data should be viewed in conjunction with the description of indices used.

THE VALUE OF YOUR INVESTMENT CAN FLUCTUATE. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

Back to top