- All trading activity has market impact.

- The trading activity associated with index tracking often dampens index returns, effectively creating negative alpha.

- Contributing to the market requires a state of mind in which tracking and beating an index is not the holy grail of investing.

Markets are not a train that one can hop on and hop off without impacting its timetable. All trading activity has market impact. In fact, market impact is the only force that drives prices. Think about it: the Apple share price does not go up because the company presents great figures – it goes up because investors are willing to pay more for a share than they did before. That could be because of the figures presented. But the impact is the same when investors are buying for any other reason. For instance to track or beat an index.

Index investing involves very little trading for the person buying the investment. But for the market participant offering it, index investments do require trading. Whether it is to adjust for changes in the composition of the index or for in- or outflows, for instance due to investors rebalancing across different ‘passive’ investment strategies. All this trading activity will impact the markets that together make up the index. As we will illustrate, a direct impact is that this trading dampens the index returns. This is an impact that an investor seeking to track the index does not take into account when he benchmarks his returns to the index.

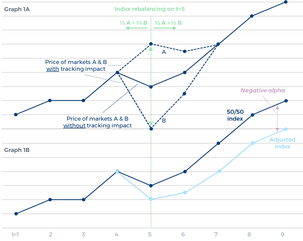

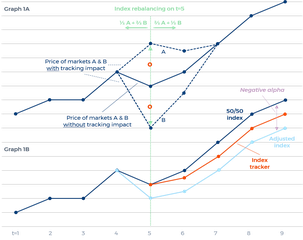

Graph 1 – The direct market impact of index tracking

To understand the mechanism we assume an imaginary index consisting of only two markets that are essentially the same: without any index tracking trading impact, their returns would be identical (the blue solid curve in Graph 1A). Because they are identical, all indices composed of any linear combination of these two markets would have the exact same returns. Further assume that this specific index consists of one third of market A and two thirds of market B initially. On the close of the fifth day this index will be adjusted, to two thirds of market A and one third of market B. All investors tracking this index will then have to buy market A to double their position in A; and they will have to sell market B, to halve their position in B. It is naïve to assume that this can be done without market impact. In the real marketplace, market A will close higher and market B lower as a result of the index rebalancing − we assume by three units either way. After some time, let’s assume two days in equal steps, this temporary mispricing will be corrected, and markets A and B will return to the levels that they would have had without the index trackers’ impact (the upper and lower dashed lines in Graph 1A showing the price series of markets A and B, respectively).

To examine what happens to this index as a result of its composition adjustment, let’s have a look at an alternative, unadjusted, index comprised of 50% in markets A and B (the dark blue curve in Graph 1B). The returns of this 50/50 index are exactly what the returns of markets A and B would have been without the impact of the investors tracking the other, adjusted index: during the mispricing the impacts on markets A and B cancel each other out in this particular combination; after the correction, any unadjusted combination of A and B will again have the same returns. The adjusted index’s returns however (the light blue curve in Graph 1B) lag the 50/50 index by a unit per the close of the fifth day, by a unit and a half per the close of the sixth day, and by two units per the close of the seventh day. This underperformance will remain until the next revision of the index.

Markets are not a train that one can hop on and hop off without impacting its timetable.

This is the direct market impact of the trading activity associated with index tracking. One could say that the dark blue curve represents the beta of a truly passive long-only investment in these markets. An index tracking strategy achieving the returns of the adjusted index, the light blue curve, delivers this beta with a negative alpha.

The mechanism is straightforward. Whenever trading an index requires a position to be increased, in this example in market A, the buying activity will drive up the existing position’s price, after which a price correction to the ‘true’ price will follow. However, the upward impact of buying necessarily affects the previous smaller position, whilst the downward impact of the correction affects the resulting larger position. Conversely, for every position that needs reducing, the downward impact of selling affects the previous larger position size, whilst only the resulting smaller position is affected by the upward impact of the ensuing correction.

Some investors may think that their investment will not be vulnerable to this mechanism because they are directly invested in a fund or other structure that follows this index, so they do not need to trade to keep track with the index. But such structures can only be offered by intermediaries who do execute the necessary trading activity, and the index will bear the market impact that these intermediaries’ activity will bring. Other, relatively small investors may think that they will not be affected due to the small size of their orders. But small order size will not help either, when there are other, larger investors tracking the index along with the smaller ones.

Of course, most large index investors are very well aware of their potential market impact. But often they seem to consider this something bad that the market does to them, rather than something that they do to the market. Efforts aimed at getting a return close to the index, motivating traders to accomplish this or even giving them an incentive to do better than the index, are likely to make things worse.

Graph 2 – The direct market impact of index tracking

Back to the fifth day in the example above. An index investor who manages to move market A up, by buying large quantities towards the end of the day and paying an average price nicely in the middle, i.e. one and a half units higher instead of the three units higher at the close (and who similarly sells down market B) − that investor will outperform the index that is his benchmark (the red curve in Graph 1B ends up higher than the light blue curve). But for every unit that he outperforms his index, he will have underperformed the index’s returns as they would have been without his activity. So the only reason that this index investor outperforms his benchmark is that he actually brings the index down; he adds nothing to his own performance, nor does he contribute anything to the functioning of the market.

When the only investment task at hand is to follow a simple set of rules, without due regard to the effect on the marketplace, both the returns of the investment strategy and the marketplace will suffer.

This is what ‘trying to outperform an index’ unfortunately often comes down to, especially where it concerns indices that require a lot of trading activity, such as commodity indices. Index trackers’ typical trading activity, of relatively large moves in a relatively short window just before the market closes, can for instance be seen in the constituent markets of the Goldman Sachs Commodity Index, just to name a popular one.

Other ‘passive’ investment strategies that have been growing in popularity, such as certain smart (alternative) beta products, also bring such activity to markets. In fact, any investment manager who promises to deliver a return series that can be composed of observed market prices, while those market prices are actually impacted by the trading activity of that investment manager, is prone to deliver this self-imposed negative alpha. When the only investment task at hand is to follow a simple set of rules, without due regard to the effect on the marketplace, both the returns of the investment strategy and the marketplace will suffer. Truly active investment managers striving to buy low and sell high − making the market instead of beating it – are necessary to counter this growing market force.

That is why a reward for simply outperforming an index should be regarded as a perverse incentive. Its muddy footprints have contaminated many markets. Of course, if we expect investors to beat the market, if we make their pay dependent on by how much they beat the market, we should not be surprised that markets will indeed get beaten up. Contributing to the market requires other incentives and another state of mind, one in which tracking and beating an index is not the holy grail of investing.

Transtrend's position

We do not offer any investment strategies that are designed to track or beat the returns of an index; nor do we offer any smart beta type products or strategies. Also, the fees for our products and services do not depend on the returns of an index. Only offering absolute return strategies, however, does not automatically make our operation immune to the mechanism described above – outperforming a benchmark by negatively impacting that benchmark. All trading activity has market impact. This also holds for the trading activity of our strategies.

This mechanism comes into play the moment order execution is separated from the investment strategy. Whether order execution is carried out by an in-house trading desk or outsourced, investment managers will want to evaluate the effectiveness of their execution. Preferably in a quantitative way, by comparing fills with a benchmark. In our industry the resulting measure is called slippage; nowadays also frequently referred to as transaction cost. The problem is: how to define such a measure in such a way that the trading activity itself does not impact the benchmark? Because when an execution desk can impact the benchmark, there is an incentive to outperform the benchmark by – in case of a buy order – driving up the benchmark instead of buying at the lowest price possible.

We do not outsource order execution. And the variable component of our traders’ remuneration has never been linked to any slippage numbers. But in our experience, even that doesn't necessarily protect the order execution from this type of negative alpha. When slippage numbers are calculated for evaluation purposes, it is human nature to try to minimize these numbers. Commercial considerations could be another motivation; investors would welcome low slippage numbers.

Back in 2007 we designed a slippage measure around a basis price that is not impacted by our own trade activity. Moreover, this slippage measure only serves as just one of the indicators in our daily trade evaluation process. The complete evaluation process is more qualitative than quantitative. And in this evaluation the execution is definitely not separated from the strategy.