Trading alternative markets

Highlighting some of the cornerstones of many successful CTA programs.

Highlighting some of the cornerstones of many successful CTA programs.

The number one theme in investment management during 2020 has of course been the COVID-19 pandemic. Before the coronavirus outbreak however, a hot topic in the CTA industry was ‘alternative markets’, a theme that certainly hasn’t disappeared. While a lot of what is said about trading alternative markets can be regarded as marketing talk, we believe there is some truth to the story. But in the end, isn’t ‘alternative markets’ just a new banner highlighting some of the cornerstones of many successful CTA programs?

Back in 1992, when we started to offer our Diversified Trend Program (DTP) to external investors, CTA programs by themselves were regarded as scary alternatives. Firstly because CTAs traded futures contracts, instruments that were hardly used by mainstream investors, certainly not in Europe. And even worse, most of these futures had commodities as underlying market, an area that mainstream investors were not really familiar with in those days. I still remember the frowning faces, as if we offered sprouts to little children.

For CTAs like Transtrend however, commodity trading was our starting point. And from there, we never hesitated to broaden the scope of underlying markets or traded instruments. Which CTA doesn’t trade OTC FX, for instance? The main argument for expanding the universe of traded markets has always been diversification. Which also happens to be one of the currently popular arguments for promoting alternative markets.

From this historical perspective, the recently popular view of alternative markets being a distinct set of markets different from the mainstream CTA markets, to be traded in a separate program, is at odds with the historical success of CTA programs, while at the same time embracing the roots of that success: good (or even better?) opportunities in different markets that offer diversification.

Alternative markets don’t seem to form a coherent set defined by one or two common characteristics that set them apart from other markets.

When we look at the list of often cited examples of alternative markets, these markets don’t seem to form a coherent set defined by one or two common characteristics that set them apart from other markets. It’s simply an assorted group of markets with a variety of underlying markets, just like the mainstream CTA markets are a diverse set of markets with a variety of underlying markets. The reason that certain markets are labeled as ‘alternative’ seems to be that they fit one or more of the following criteria:

To be fair, all these alternative markets do in fact have one important characteristic in common: they require special attention. But again, that doesn’t differentiate them from the mainstream futures markets. No CTA will trade metals on LME exactly the same way as metals on CME. No CTA trades Australian 10-year notes exactly the same way as U.S. 10-year notes. And back in the nineties, when some of the largest commodity futures contracts were listed in Japan, no CTA traded Azuki red beans exactly the same way as soybeans in Chicago. Special care and attention always needed to be at the basis of a uniformly applied real-life trading program. This hasn’t changed.

When we consider the passionate stories about alternative markets as being mostly marketing talk, this clearly holds for the often mentioned sunflower seed futures. These contracts are traded most actively in Johannesburg, South Africa. During 2020, this market indeed experienced a very strong and potentially profitable uptrend. But suppose a trader would have bought around the bottom and hold that position all the way up to the top. This trader would hardly have made more than 3 million U.S. dollars on the trade, assuming a position size of 10 percent of the open interest. This might be a significant return for a sub-100 million dollar trading program, but it doesn’t really move the needle of a billion-plus program.

Within DTP we nonetheless have been trading sunflower seed futures for many years already, just as we trade or have traded many other smaller agricultural futures markets. With our background of (physical) agricultural commodity trading, we have been trading markets like oats already before the start of DTP. Just like palm oil, which also has been part of DTP’s market universe since the start of the program. During the eighties, our predecessor was one of the largest participants in Malaysian palm oil futures. Maybe for that reason, we’ve never regarded palm oil as an alternative market. And we wouldn’t call this specific market a small market either. In fact, this year it has been one of the largest contributors to the performance of DTP in U.S. dollar terms.

Our long-term experience in trading such markets has made us very much aware of the importance as well as the fragility of these markets. Being a large participant in such markets brings a responsibility. These markets do not exist to offer large traders an opportunity to accumulate uncorrelated returns. They exist to facilitate price discovery and to offer participants in the physical markets a way to offload (part of) their market risk. Speculative investors can play an important role in this process, but – even more so than in the larger markets – this requires an active and responsible way of participation.

Order flows sent to these markets in a less responsible way can easily disrupt these markets. In the past few years we have observed signs of such disruptions in many of the smaller markets: short-term price disruptions that are typically caused by participants who trade in a ‘liquidity-unaware’ manner. We don’t know whether or not these participants are CTAs. But this phenomenon should be relevant for investors considering to allocate to alternative markets. One of the points in the sales pitch of alternative markets is that these markets would exhibit better tradable trends. Especially when this statement is based on results from historical simulations, this could easily lead to disappointing real-life trading results in today’s markets.

The smaller agricultural markets do not exist to offer large traders an opportunity to accumulate uncorrelated returns. They exist to facilitate price discovery and to offer participants in the physical markets a way to offload (part of) their market risk.

What holds for the smaller agricultural markets holds for many of the popular alternative markets. The special care and attention these markets require definitely includes attention to execution. Without it, the resulting market impact can easily disrupt these markets and will probably be penalized by high indirect trading costs. Trading these markets can better not be done in a liquidity-assuming way but instead in a liquidity-providing way. This implies that the moments of trading and the sizes to trade are not predetermined but attuned to the actual activity in the market. Which, while we’re at it, differs from the widespread academic view on the functioning of systematic trading strategies.

Part of the alternative markets hype is that they are offered in separate trading programs. We certainly understand the commercial reasons behind this, but purely from an investment point of view we cannot find a valid reason. Crucial here is that these markets do not form a coherent group setting them apart from other markets. The classification is in fact rather subjective and certainly not robust.

In a way this is comparable to the ongoing stock market debate whether or not South Korea should still be classified as an emerging market. Some of the suppliers of large Emerging Market equity funds have actively been lobbying at the index providers to hold on to the EM-classification of South Korea, for the very simple reason that they want to continue to invest in South Korean stocks. But whether or not an investment manager thinks it’s wise to invest in South Korean stocks is at the full discretion of this investment manager and should not be dependent on some external classification. Similarly, for a CTA, whether or not to trade a certain market should not be determined by the classification of that market as ‘alternative’. As a CTA investor you typically want to participate in large market moves. You probably don’t want your investment manager to not be positioned just because the specific market has (or lacks) a certain classification.

Their lower correlation with other markets, and therefore their diversification benefits, are other points in the sales pitch of alternative markets. But for us, these correlation and diversification characteristics are an important argument for including these markets in the same program that trades the mainstream markets. This way, we can most effectively optimize the diversification on an aggregate level.

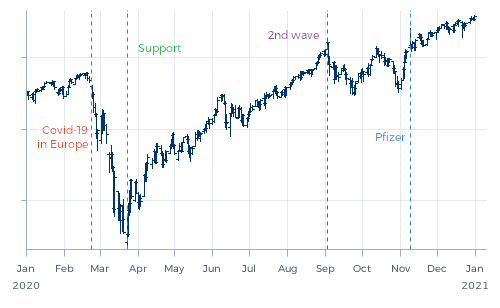

This reasoning starts by recognizing that these alternative markets are not traded in a different, isolated universe. They may be lower correlated, but they are still sensitive to the same global factors that impact most mainstream markets. This can be illustrated by looking at the global, coronavirus-dominated market moves in 2020, as shown in the graph below.

When the virus turned out to have spread to Europe on 23 February, this triggered a global sell-off. Markets bottomed already one month later on the back of massive financial support by governments and central banks. What followed was a global recovery trend, which continued throughout the summer. This one big trend peaked in the evening of 2 September. The widespread reaction that followed seemed to have been triggered by among others the flaring up of the virus (the ‘second wave’) in Europe. Subsequently, different markets went in different directions for a while, but on Monday 9 November, when Pfizer published promising test results, this had widespread market impact again.

We’ve marked these four events in all the graphs in this article. It’s hard to find a market that seems to have been completely immune to the virus. And even though the pandemic in itself wasn’t foreseeable, the fact that such a pandemic would also impact most alternative markets was foreseeable. Therefore, an allocation to mainstream futures markets and an allocation to alternative markets do share sensitivity to common factors. When these markets are traded in one and the same program, the aggregate sensitivity to each of these factors can be controlled most effectively.

An allocation to mainstream futures markets and an allocation to alternative markets do share sensitivity to common factors.

For instance, when we take a closer look at the recovery trend from 23 March onwards, we can see that different factors were driving this trend. In Europe and North America, the financial support mentioned earlier was the key driver. In many Asian and Pacific countries however, the spreading of the virus itself was pretty well controlled. These different drivers did fuel somewhat different trends in different markets. For example, among the strongest rising stocks in the U.S. and Europe were those of firms hardly hit by the pandemic, or that even benefitted from it, such as the typical ‘staying-at-home’ stocks. While in Asian and Pacific countries, real economic recovery was leading the way back up.

With DTP we strive to be sizable invested in different trends. In 2020, one of these trends was an APAC recovery trend. This included long positions in the currencies of these countries, in their stock markets, and in the commodities that are required most to drive the economies in these countries. A large part of DTP’s positions in this trend was in synthetic markets, many of them including a short leg in another market. When allocating to these markets we are indifferent whether these markets are synthetic, or whether they could be qualified as ‘alternative’ for some other reason. The only factor that matters is whether they are part of that same underlying trend.

One of the markets at the core of this trend was iron ore, which turned out to be DTP’s most profitable position in this trend. In fact, the program’s long position in iron ore turned out to be its most profitable position in 2020. We could say we profited from trading alternative markets. But that’s not what we were aiming for. We wanted to participate in a sizable way in a major trend. And we succeeded with this particular trend. If the largest return in this trend would instead have come from long positions in the New Zealand dollar, this wouldn’t have made things any different for us. And we imagine that most of our investors won’t have an alternative view on that.