The market is not a shop

What really defines a well-functioning market?

What really defines a well-functioning market?

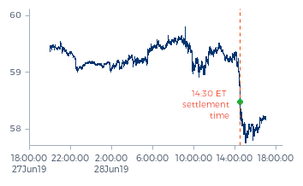

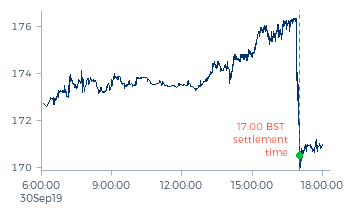

On 28 June 2019 during the 15 minutes before 14:30 ET, WTI Crude Oil dropped 1.3 percent. This price move was not in response to relevant news around supply or demand for oil. There was no news from OPEC, no inventory reports, simply nothing of that kind. The only ‘news’ was that 14:30 ET is the settlement time of the CME contracts and that Friday 28 June was the last business day of the week, month and quarter. What, then, triggered the sell-off?

The price of the futures contract dropped simply due to aggressive selling. We would not be surprised if most of this selling was done by market participants who decided earlier that day they wanted to sell. These participants were however not willing to execute these orders during the day at any price. Instead, they seemed determined to sell at any price close to the settlement.

Similarly, on 30 September 2019 during the 10 minutes before 17:00 BST, LME Nickel dropped by 3.3 percent. Again, the only ‘news’ was that 17:00 BST is the settlement time on LME and that 30 September was the last business day of both the month and the quarter.

These are two clear examples of price-insensitive execution, where orders are effectively sent to the market without price limits. End of week/month/quarter trading sessions are especially prone to these practices. But this doesn’t just happen towards settlement and not just on the last day of a reporting period. On a daily basis we observe that a vast amount of the order flow in financial and commodity markets is in essence price-insensitive. We regard this as one of the symptoms of a major development in the past decade: a worrisome change in attitude of many stakeholders towards the role and functioning of markets.

In June 2019 I was invited by Eurex to their Derivatives Forum in Amsterdam to debate several new technical amendments to the market structure. A discussion on the appropriateness of changes made by the exchange naturally requires a shared sense of what defines a well-functioning exchange. We proposed the audience the following definition:

Close to 60 percent of the audience confirmed this to be a proper definition. We continued by proposing an alternative one:

We were relieved to see that more than 80 percent of the audience confirmed this to be a better definition. Why? Because the first definition defines a shop, not an exchange. The fundamental difference between the two: in a shop, prices are set by the shop owner and consumers may expect to buy at these prices, whereas on an exchange the prices are the outcome of negotiations between market participants. The exchange itself is only instrumental in this process; it facilitates the infrastructure, determines the rules and supervises the process. But it does not determine the price.

This was already the leading principle on the Forum Mercatum in the Roman Empire. The physical meetings on a central marketplace in major cities may have been replaced by electronic ‘gatherings’, but that has not changed the responsibility of buyers and sellers to negotiate a fair price. In the last decades, however, we have observed a change in attitude among market participants to treat markets as if they were shops. And this conviction is not only shared by a growing number of investors, but it also seems to have been embraced by academia, regulators and exchanges.

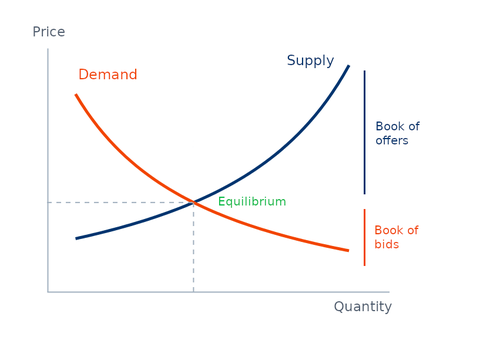

According to traditional microeconomics, in a competitive market the equilibrium price for a good is the level where supply meets demand. At the basis of this theory is a supply curve that increases with price and a demand curve that decreases with price. The equilibrium is found where these two curves intercept.

A necessary condition for such an equilibrium is that not all orders sent to the market will be filled. A stable equilibrium requires a sizable book of offers resting above the equilibrium price and a sizable book of bids resting below the equilibrium price.

Price-insensitive orders are defined as orders that have to be executed irrespective of the price. Popular examples are orders that are executed in an electronic order book by applying a VWAP or TWAP strategy. Market participants sending price-insensitive orders to an order book are essentially expressing a vertical demand curve (when buying) or a vertical supply curve (when selling). An important characteristic of vertical curves: they do not cross! If all orders would be price-insensitive, no equilibrium would be reached. An abundance of price-insensitive orders makes the market price highly sensitive to additional demand or additional supply and will inevitably lead to sudden price swings. The market moves in oil and nickel presented earlier are just two examples.

A stable equilibrium requires a sizable book of offers resting above the equilibrium price and a sizable book of bids resting below the equilibrium price.

According to traditional equilibrium theory, additional buyers entering the market will cause prices to rise. To get their orders filled, buyers will have to bid up the market to replace less aggressive buyers and/or to meet the demand of the less aggressive sellers. This price impact is part of the transaction costs of an investment strategy. The academic community used to give considerable attention to these costs in their research and papers.

An example related to our business is a research paper on the profitability of technical trading systems conducted by Lukac and Brorsen in the late ‘80s, published in The Financial Review in November 1990. In their testing the authors assumed transaction costs of $100 per contract. In the presentation of their results they noted: “Results were quite sensitive to assumptions about transactions costs due to the relatively small returns per contract traded.” These kinds of remarks were quintessential for the academic finance literature in the ‘80s, which was often aimed at testing the Efficient Market Hypothesis in some form. Common practice was that articles showing evidence of non-efficiency were questioned on their assumptions around transaction costs. Would their conclusions still hold if ‘more realistic’ assumptions were made?

In contrast, in a comparable piece of research conducted by Hurst, Ooi and Pedersen, published in the Journal of Investment Management in February 2013, the authors stated: “The strategy returns are gross of transaction costs, but we note that the instruments we consider are among the most liquid in the world.” The fact that this article has been accepted for publication in a peer-reviewed community illustrates a remarkable development in academic practice. Apparently, the idea that trades can be executed without market impact has become generally accepted – a 180-degree turn in culture compared to three decades ago.

What academia nowadays teaches or publishes is put into practice by the students of this new version of microeconomics. A result of that is the May 2010 flash crash in the S&P 500 futures, indisputably one of the most liquid instruments in the world. According to an SEC/CFTC report, this crash was triggered and fueled by a large mutual fund that “sold a total of 75,000 E-Mini S&P contracts (valued at approximately $4.1 billion) without regard to price or time” – another example of price-insensitive execution. According to traditional economics, a market would indeed not be functioning properly if such a large sell order would not cause a price decline. Prophets of the new school of economics, however, have come up with various alternative explanations for this flash crash.

But if execution has no market impact anymore, what other force would then make markets move? It is still generally accepted that Apple’s stock price should rise when Apple is very successful in developing, producing and selling its products. But how should that price rise materialize when it is not due to the market impact of investors buying the stock? Should the correct price level be set by a central committee like the former Soviet fondoderzhateli? Or should the correct price be determined by the market supervision department of the exchange? If so, this would turn the exchange into a shop.

An intriguing perspective on this phenomenon is presented by Ben Carlson, CFA in a story posted in September 2019 on his blog A wealth of common sense. Defending passive index investing, he states: “Active managers will always set the prices, no matter how many there are.” Adding: “Yes, index investors are free riders, but this is the way most markets work. We don’t go to the grocery store to bid on prices of oranges against one another to set an equilibrium. The market does that for us.” So, according to this theory, there are two groups of market participants: an active, more informed group that determines the accurate prices, and a passive, potentially less informed group that can shop for those prices without market impact. If this would be true for financial and commodity markets, that would be fantastic, both from an ethical and a market functioning point of view. There is just one little problem with this theory: why would an order sent to an electronic trading venue by an active manager have (accurate) market impact, while the exact same order sent by a passive investor would have no market impact?

As long as there is no satisfactory answer to this conundrum, we choose to adhere to traditional microeconomics. In this world, price moves are the aggregate market impact of all market participants, irrespective of whether they regard themselves as hedger or speculator, informed or uninformed, passive or active. We are convinced that market impact caused by buyers and sellers is the one and only force that makes markets move. It is the gravity of the market. One can deny gravity, but that does not prevent one from falling.

Price moves are the aggregate market impact of all market participants, irrespective of whether they regard themselves as hedger or speculator, informed or uninformed, passive or active.

Regulators play an important role when it comes to supporting or correcting this trend towards treating the market as a shop. Generally, financial regulators focus on two main functions: promoting stable and orderly financial markets and protecting investors. But holding investors responsible for market functioning can conflict with the other task. This conflict seems to disappear if you simply treat the market as a shop.

A European example of this unfortunate approach is the PRIIPs transaction costs regulation. In essence, its sole objective is to secure ‘consumer protection’ for investors. This piece of regulation assumes that all orders from or on behalf of investors will be filled. But as explained, a stable market requires a sizable book of conditional orders resting above and below the current equilibrium price. These are orders that potentially will not get filled. The regulation does not explain how the assumed market functioning would lead to stable markets. Apparently, the regulator believes this is something investors should not worry about. The ‘market’ ought to do that for them.

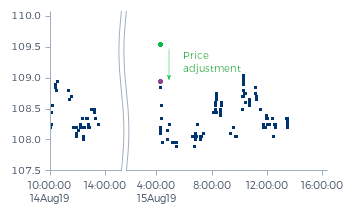

Another example is the ongoing discussion about potential ‘error trades’. For instance, on 15 August ICE Arabica Coffee started with a trade at 109.55 cents per pound. After the next trade was executed at a significantly lower price, the ICE Futures Market Supervision decided to adjust the first traded price downwards to 108.95, with the sole explanation that the price was set outside the no-cancellation range. It did not mention any irregularities in the functioning of the matching algorithm nor any errors by the participants involved. All that happened was that the buyer got filled on the bidded price. The simple fact that the market traded lower immediately afterwards does not imply the first trade was an error, correct? Moreover, would it have been labeled an error if the price went up after that first trade? If not, then the selling party effectively did not sell a futures contract, but a free call option.

We regularly question such price adjustments or trade cancellations. A standard response from exchanges – especially U.S. exchanges – is that regulators effectively force them to employ such an approach. We have not been involved in these particular discussions between exchanges and regulators, but if this policy is indeed promoted by regulators, then they essentially relieve investors from their responsibility to negotiate fair prices. And it forces exchanges to determine the right price, as if they run a shop.

Market functioning becomes extremely complex and arbitrary if the responsibility for price discovery is taken away from the traders who are buying and selling.

If you treat the market as a grocery store and focus on investor protection, then with hindsight you might argue that the investor buying the Arabica Coffee contract paid an unreasonably high price. From that perspective, the price adjustment seems like an adequate measure to protect the investor. Now consider the regulator’s other task: promoting stable and orderly markets. Penalizing market manipulation is an important element of market supervision, but what behavior should be classified as manipulative is not always crystal clear. Our Dutch regulator once explained to us one of their rules of thumb: bidding a price that one is not really willing to pay will be considered as manipulative. Spoofing is a clear example of that. Is it fundamentally different to bid a price expecting it to be adjusted if the market trades lower immediately afterwards?

Such ‘trading activity’ undermines not only the integrity of the market, but also its stability. Once again, a stable market requires a sizable book of conditional orders resting above and below the current equilibrium price. Placing offers above the market is very uneconomic, however, if you run the risk of selling a call option at zero premium instead of a futures contract at a decent price. Consequently, market participants willing to sell above the current price are effectively encouraged to postpone placing their offers until the market trades near the level they are willing to sell. Which increasingly makes trade execution a rat race favoring market participants with the fastest connections and the largest order sizes, as speed and size put them first in line to get filled.

If real market depth is strived for, exchanges should consider fostering market participants who are willing to add to that market depth. And it seems that some exchanges could use a little more backing from their regulator in order to be able to do so.

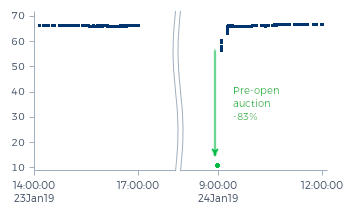

Earlier this year, the Singapore Exchange (SGX) made this choice. On 24 January, 167,500 Jardine Matheson shares traded at 10.99 Singapore dollar during the pre-open auction – far below the day’s previous close of 66.47. The price bounced back moments later, implying a loss of about 9 million Singapore dollar for those who sold at the pre-market level. SGX decided not to cancel or amend these trades, stating the sellers had ample time to withdraw orders if they didn’t want to sell at the low price. Offers far outnumbered bids during the pre-open and neither a fat finger nor a malfunctioning computer system was to blame. In short, the SGX reminded the selling parties and their executing brokers that they were not defenseless victims of this flash crash, but responsible for it. We assume the SGX felt backed in this assessment by its regulator.

Every price set on a futures exchange is essentially an agreement between two participants, with the agreed upon price being relevant only for these two parties. This holds for every price, except for one: the settlement price. The daily settlement price is relevant for all parties who directly or indirectly hold a position in a listed futures contract. It determines the amount of variation margin to be deposited, it is used as a reference in off-exchange deals between commodity producers and processors and it serves as a cornerstone of fund valuation, where it is especially relevant in case of additions and withdrawals.

All of this requires the integrity of the settlement process to be indisputable. For good reason the CFTC regards ‘banging the close’ as a manipulative or disruptive trading practice. Regretfully, we regularly witness price moves during the settlement minutes that do cast doubt on the integrity of the settle. In addition to the oil and nickel price moves presented above we’ve included a few other examples below.

We are inclined to believe that most of these suspicious price moves are not the result of intentional manipulation. Rather, the naive embrace of the shop model seems to be at the root of this phenomenon. As stated before, the exchange is not a shop and therefore not responsible for the prices set. But the exchange is the first responsible for the settlement process. Before fund managers even start questioning the integrity of settlement prices, alarm bells should go off at the exchange. When we report suspicious price behavior around the settle, however, exchanges typically tell us “It is a legitimate right for traders to trade on the settle” or “The exchange operates in the best interests of all market participants”. But do exchanges really want to be free ports for all market participants, irrespective of their willingness to contribute to a sustainable price discovery process? And to what extent do exchanges want to facilitate the specific demands of these various participants?

With regard to the functioning of the settlement process, indisputable valuation and unlimited trading are conflicting objectives.

The microeconomic foundation of a correct price is that it results from negotiators who prefer to buy low and sell high. This also holds for the settlement price. And this foundation is directly undermined by price-insensitive participants who rather sell at the settlement price – no matter how low – than to sell at a higher price. We can think of various measures that would improve the integrity of the settlement process. They all share a common characteristic: they make it harder to trade at the settle, let alone manipulate it. It might sound undesirable, but with regard to the functioning of the settlement process, indisputable valuation and unlimited trading are conflicting objectives.

Embracing the popular shop model, the ability to trade at settle nowadays seems to be prioritized by various exchanges. One way of facilitating this demand has been the introduction of trading-at-settlement (TAS) orders. TAS allows market participants to buy or sell relative to the daily settlement price before that price has been determined. Over the years, TAS has been associated with several efforts to artificially influence the settle. Exchanges respond to these signs of manipulation by stating that such trading activity will be subject to disciplinary action. But why does an exchange even offer an order type that at the very best can be used as a tool for market participants to walk away from their responsibility to negotiate a fair price? The importance of the settlement demands more commitment.

Frankly, it surprises us that after the Libor-fixing and FX settlement scandals the (similarly) suspicious daily settlement in futures markets has barely gained the attention of regulators. Could it be that regulators have also prioritized the popular ability to trade at the settle over the integrity of the settle? We surely don’t hope so.

Let’s have one final look at the settlement moves in oil and nickel. Common sense suggests that there has to be relevant information supporting these price drops. Otherwise investors would have bought, or at least not sold. Why then, without such information being present, would rational investors sell precisely in such declines instead of half an hour earlier at higher prices? The simple economic answer has to be: because they believe it pays off.

Many trading desks that execute price-insensitive orders get their fills benchmarked versus the settle. If they sell above the settle, they’ve done a good job. Consider the oil example: a whopping 80% of the volume in the final 15 minutes of the session traded higher than the settlement price. In nickel it was all of the volume. In other words, most traders who sold probably believe they did a decent job as they beat their benchmark, without considering the disruptive market impact they had. As long as traders are rewarded for beating a settle, they will continue to trade in this manner. But think about it: how is their objective really different from that of a ‘liquidity provider’ who first buys TAS and subsequently sells the contract towards the settle? ‘Providing liquidity’ in this manner will likely be judged as manipulative. At least, that’s what we hope.

This shows why the generally accepted use of the daily settlement as a benchmark for judging the performance of investment strategies is another factor that undermines the integrity of the settlement process. This long-term development flourished from the same school of thinking as the shop model.

When discussing market participants, one tends to focus on investors. But it’s not only investors who trade futures contracts. In defending the correction of suspected error trades, for instance CME argues that it has a special responsibility towards commercials. We fully understand this responsibility; the ability for commercials to hedge their future supply or demand is the raison d’être of futures markets. However, that doesn’t relieve commercials from their responsibility to negotiate fair prices. Any commercial will understand that this is the way markets work.

We can understand that some commercials do not want to negotiate by themselves. These commercials can outsource the execution to a better equipped executing broker – as was the standard model before trading venues turned electronic. But not by just submitting unlimited orders through the brokers’ standard execution algorithms. Rather, it requires executing brokers to really work orders. Such brokers should not be judged on their capability to beat a benchmark such as the daily settle, but on their ability to achieve truly fair prices, thereby contributing to a sustainable price discovery process.

We firmly believe that the current trading practices deserve rethinking and that the definition of the settle of futures contracts should be improved. We call upon academics, exchanges, regulators and market participants to reconsider current practices in light of ensuring stable and orderly markets. Let’s not settle for less!